Note: Distinguished Programs no longer offers Builder’s Risk or Vacant Building insurance through our City Insurance division. Explore our other programs for tailored solutions.

Remodeling and construction projects are no small feat. They involve intricate planning, skilled labor, and significant financial investments. But what happens when unexpected events, like fire, theft, or vandalism, threaten to jeopardize all the hard work and resources invested in a construction project? This is where Builder’s Risk insurance steps in.

In this comprehensive guide, we’ll equip you with the knowledge to confidently advise your clients on Builder’s Risk insurance in New Jersey. From the basics of what it covers to specific examples of when it may be necessary, this guide will help brokers better advise their clients and ensure they are adequately covered during construction projects. Let’s get started.

What is Builder’s Risk Insurance?

Builder’s Risk insurance provides temporary coverage for buildings under construction and properties undergoing remodeling or renovations. The policy has a specific duration, typically ranging from three to twelve months.

It safeguards the financial interest of individuals or organizations involved in the project, protecting the cost of construction and the materials, fixtures, and equipment used. With construction-related hazards and fluctuating values, those with a vested interest in the project face unique challenges. It addresses the various risks owners, and contractors may encounter, safeguarding their assets in the event of a loss.

What does Builder’s Risk Insurance Cover?

Builder’s Risk insurance covers damages caused by fire, lightning, hail, wind, theft, and vandalism, offering comprehensive protection throughout the construction process.

Types of property covered in the policy include current structures; new construction; foundations and underground property; and other property such as scaffolding, temporary buildings or structures, fencing, antennas, and materials stored outdoors or outside of a predetermined distance from the project.

Watch Out for These New Construction and Remodeling Hazards

In New Jersey, Builder’s Risk insurance is essential to protect against a range of hazards commonly faced during new construction and remodeling projects. These hazards can have devastating consequences if not adequately addressed. Imagine an unexpected fire engulfing the work of a contractor, the theft of valuable on-site tools and equipment, or vandalism targeting completed work on the job site.

Moreover, water damage poses a significant risk, being one of the most frequent causes of losses during construction. Whether it’s a slow leak, a burst water pipe, or a sudden flash flood, the resulting water damage can lead to substantial financial losses, easily amounting to hundreds of thousands of dollars.

Understanding and addressing these hazards is crucial for ensuring comprehensive Builder’s Risk coverage and safeguarding construction projects.

Who Is Covered with Builder’s Risk Insurance?

The policy should include anyone with a financial stake in the construction project, such as general contractors, homeowners, house flippers, developers, architects, subcontractors, and lenders. In addition, prior to issuing building permits, local government agencies will usually request proof of insurance.

Accurate Cost Assessment: Determining the Total Completed Value (TCV)

Because Builder’s Risk insurance is based on the total completed value (TCV) of the project, it’s important to accurately determine all the costs associated with the construction and design of the property. This includes labor, overhead (e.g., payroll, admin fees), materials, architect fees, zoning changes, etc. Changes to the completed value are common during the course of construction and should be reported to the insurer so that the policy is endorsed to reflect the correct value.

In addition, stress the importance of determining the agreed value or stated value on the existing structure during a remodel to avoid coinsurance issues. Insurers typically cover the existing structure on an actual cash value basis. In addition to ensuring that the valuation of the existing building is correct, a proper valuation of the betterments being made to the property is also required.

Discuss the Vacancy Clause for Remodels

When Builder’s Risk insurance is purchased for a remodeling project, make sure the insured understands that work must begin within a certain time period once the policy goes into effect. In New Jersey, Builder’s Risk insurance must begin within 45 days of the policy’s inception date. If work does not begin within the 45-day window and there is a claim, coverage can be denied.

A Builder’s Risk policy includes a vacancy clause limiting the time an existing building can remain vacant. This is due to the increased exposures that come with a vacant building. This clause ensures that the building remains occupied or secured to mitigate the risk of loss or damage.

Mitigating Losses

Safeguarding construction projects in New Jersey against potential losses requires proactive measures to prevent and minimize the impact of unforeseen events. With the state experiencing a growing frequency of severe weather events and flooding, construction sites face increased vulnerability. New builds often have incomplete or temporarily supported weakened structural systems, unsecured building envelopes, and the presence of loose materials and debris, all of which heighten the risk of damage. Structural and component damage can occur due to unmanaged construction debris, while compromised windows and doors can facilitate water intrusion. Storm surges pose a threat of flooding, potentially impacting low-lying structures, foundations, and retaining walls. High winds and flying debris also pose risks, including the collapse or damage of cranes and other equipment.

To mitigate these risks, a well-preparedness plan is paramount. This includes monitoring weather forecasts closely and promptly activating the plan. Protective measures encompass securing immovable equipment and materials, halting deliveries, closing doors and windows, securing hazardous chemicals, anchoring construction trailers, removing loose materials, implementing sandbagging, and implementing other water damage prevention measures.

By diligently following these precautions and having a comprehensive preparedness strategy in place, construction projects in New Jersey can effectively shield structures, equipment, and materials from potential losses and ensure their successful completion.

Coastal Builder’s Risk Insurance in New Jersey

In addition to Distinguished general Builder’s Risk program, we also offer Builder’s Risk insurance for coastal properties in New Jersey. With unpredictable weather patterns and natural disasters that often affect the coastal region, it is important to have insurance coverage that is specifically tailored to the risks of owning a property in this area.

The policy is written on an all-risk basis, which means that it provides coverage for a wide range of risks that may arise. This includes debris removal, pollutant cleanup and removal, and sewer and drain backup, among other coverage features.

Additionally, the policy includes a named-storm deductible for coastal properties, which is important because of the increased risk of storm damage in these areas.

The policy is written on an all-risk basis and provides cover for debris removal, pollutant cleanup and removal, sewer and drain backup, and other coverage features. There is a named-storm deductible included for coastal properties.

Our Coastal Builder’s Risk Insurance policy for New Jersey includes the following limits:

- $20 million TIV New Construction (except frame)

- $6.5 million TIV Frame New Construction

- $5 million TIV Remodelers and Betterments Only

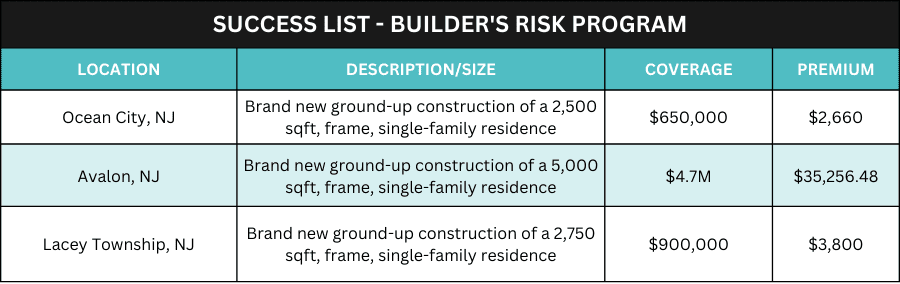

Recent Successes for Coastal Builders Risk Insurance in NJ

Some of our recent placements in coastal areas in New Jersey include:

Submit Business Online

We’ve made it easy for you to submit your business through our online submission portal. All you need to do is register your brokerage, head on over to our Broker Portal, and spend just a few minutes adding in your insured’s details.

Based on the information you provide, we’ll determine if our general or Coastal Builder’s Risk program is a better fit and send you a quote. If your clients are happy with the quote, you can easily bind the policy right there through the same portal.