Note: Distinguished Programs no longer offers Builder’s Risk or Vacant Building insurance through our City Insurance division. Explore our other programs for tailored solutions.

From Atlanta’s bustling skyline to charming coastal communities like Savannah, Georgia’s construction sector is thriving. However, with growth comes risk, and that’s where Builder’s Risk insurance plays a critical role. Whether your clients are embarking on a new construction project, renovating an existing structure, or making betterments to a property, the importance of having the right insurance coverage can’t be overstated.

In this article, we’ll take a deep dive into Distinguished’s Builder’s Risk insurance offerings in Georgia. We’ll explore the wide range of projects covered, from single-family homes to commercial buildings, and examine the comprehensive coverages that protect your clients’ investments. By the end of this guide, you’ll have the know-how and tools to navigate the Builder’s Risk landscape in Georgia and provide your clients with top-tier insurance solutions from Distinguished.

What Kinds of Projects Will Distinguished Cover in Georgia?

Distinguished’s Builder’s Risk Program is incredibly flexible, covering the majority of projects, including:

- Betterments only

- Remodeling

- New Construction

As well, we have an appetite for all kinds of buildings, which can include:

- Single-family homes

- Condominiums

- Apartments

- Buildings with mixed-use exposures

- Commercial buildings

What Does Distinguished’s Builder’s Risk Insurance Cover?

Our Builder’s Risk policies come standard with all of the most important coverages your clients will need to protect their under-construction properties.

This includes coverage for:

- General liability: Covers legal costs and damages that arise from lawsuits related to this construction, renovation, or betterment project.

- Under-construction buildings: Covers damages to buildings or structures that are under construction, renovation, or undergoing betterment.

- Temporary structures: Covers damages to temporary structures on covered sites, like scaffolding or fencing.

- Fraud and deceit: Covers up to $50,000 in damages caused by fraud or deceit to any insured.

- Limited fungus: Covers the costs of fixing damages caused by mold that result from a covered risk.

- Soft costs: Covers the kinds of soft costs that arise after a sustained loss, like additional taxes, insurance costs, or permitting costs.

For a full list of our coverages, you can take a look at our Builder’s Risk Program Page.

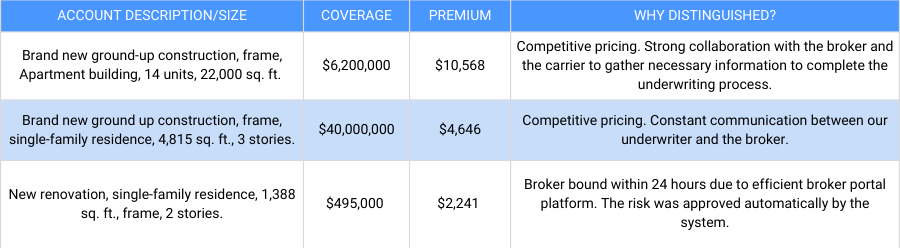

How Much Does Builder’s Risk Cost in Georgia?

Distinguished’s Builder’s Risk Insurance policies are customized based on the needs and situations of your clients. For this reason, giving an exact estimate of these costs is not possible.

However, to get an idea of what it might cost, you can assume that a Builder’s Risk policy will cost roughly 1-5% of the total cost of the work being done on the insured property. So, if your client is doing a $1 million renovation on their home, the cost of a year-long policy would be around $10,000.

When determining the end price of a policy, our underwriters will look at a number of factors that can influence whether the final premium will be closer to 1% or 5% of the total project cost. These factors include:

- The cost of the project, which is based on either an Actual Cash Value (ACV) or Replacement Cost (RC) evaluation

- Location of the project

- Environmental factors of that location

- The materials involved in the project

The only way to really know how much a Builder’s Risk premium will cost your client is to get a quote from us. To get a bindable quote from Distinguished, simply register with us and then apply through our online portal. In most cases, you’ll get a quote back instantly.

Why You Should Partner With Distinguished For Builder’s Risk in Georgia

If you’re a broker looking to expand your business to clients in Georgia in need of Builder’s Risk policies, partnering with Distinguished is one of the best ways you can do that.

When you partner with us, you get access to one of the most established Builder’s Risk programs in the country. Plus, you also get benefits like:

- Quick bindable quotes: Submit business for your clients through our convenient online portal, and you’ll get a bindable quote back ASAP. This is perfect for clients with strict, last-minute deadlines.

- Comprehensive coverages: Our program covers nearly all risks for a simple, sleep-at-night solution for all kinds of projects.

- Broad appetite: Get coverage for single-family homes, commercial buildings, and mixed-use clients all in one place.

- Expertise: Our underwriters have been insuring Builder’s Risk projects for years.

- Customer service: Our claims team is ready and available 24/7 so your clients can access funds when they need them.

- Flexible terms: Our policies can get your clients coverage for 3, 6, or 12-month increments. Once those terms have ended, qualifying projects can be extended or transitioned to a vacant or unoccupied building policy.

How to Get a Quote From Distinguished

Getting a quote for one of your Builder’s Risk clients in Georgia is a simple process that shouldn’t take very long once you’ve collected all of your client’s relevant details.

First, register with us here at Distinguished.

Once your registration is complete, use your new login information to access our online portal.

Finally, submit your client’s business through our portal. For qualifying risks, the system will return a bindable quote. For more complicated cases, an underwriting review will be required, and our typical turnaround is 24 – 48 hours.

Builder’s Risk FAQs

Don’t see the answer you’re looking for? Explore our FAQs page or reach out to one of our insurance experts.

Do you offer Builder’s Risk for Coastal Properties?

Yes, Distinguished offers Coastal Builder’s Risk insurance in Georgia. You can learn more about insuring coastal properties in Georgia on our Coastal Builder’s Risk insurance page.

Where do we offer our Builder’s Risk program?

Distinguished’s Builder’s Risk program is available across the U.S. in nearly every state. Notable exceptions are:

- Florida

- Hawaii

- Kentucky

- Suffolk County, New York

Take a look at these location-specific pages to learn more about our Builder’s Risk policies in different areas across the United States:

What is our max total insurable value?

Our program is designed to insure up to the following project maximums:

New construction & remodels:

- $7.5M maximum TIV for frame

- $5M maximum TIV for betterments only

- $20M maximum TIV for all other construction

Betterments only:

- TIV up to $5M

For more coverage information, read through our Builder’s Risk product page.