The issue of climate change is one on which the insurance industry is strongly focusing, particularly in the light of the severe weather that has devastated communities throughout the United States over the last several years. 2015 alone included 10 weather and climate disaster events across the U.S. that each exceeded $1 billion in damages. Insurers are looking for ways to address the challenges being faced through environmental initiatives at their own organizations, as well as product innovation and risk management solutions for clients.

The issue of climate change is one on which the insurance industry is strongly focusing, particularly in the light of the severe weather that has devastated communities throughout the United States over the last several years. 2015 alone included 10 weather and climate disaster events across the U.S. that each exceeded $1 billion in damages. Insurers are looking for ways to address the challenges being faced through environmental initiatives at their own organizations, as well as product innovation and risk management solutions for clients.

For example, Swiss Re has maintained climate change as a strategic priority for more than 20 years, playing an active role in developing advance sustainable business practices. Among the company’s own internal practices, the Greenhouse Neutral Programme saw the company cut CO2 emissions per employee by 49 percent by switching to renewable energy at most of the organization’s larger locations. Remaining CO2 emissions are offset by buying Voluntary Emissions Reduction certificates, which has made Swiss Re carbon-neutral since 2003.

Insurer product innovation is also playing a role in addressing contributing factors affecting the environment. For example, several insurance carriers (Hartford, Progressive, State Farm, Allstate) are offering usage-based auto insurance in which the premiums for auto insurance are dependent upon the type of vehicle used measured against time, distance, behavior, and place. Basically, you only pay for the insurance you use. Those who drive less, pay less. It’s a win-win for the consumer and for the environment.

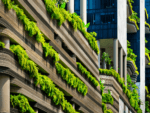

ACE and Lexington insurers have developed “green” endorsements to go along with their policies. These endorsements, which are available for an additional premium, allow insureds to repair with green materials after a covered loss occurs.

At Distinguished, we have implemented a program that is designed to help owners and managers of hotels, real estate, and habitational property realize the value of environmentally friendly pursuits while offering incentives that encourage participation. Through our exclusive AGPOM (Association of Green Property Owners and Managers) program, participating members are able to leverage many “green” benefits without making large investments in technology or manpower. This includes having access to a cost-effective green building plan; utilizing AGPOM’s group insurance program and obtaining premium discounts; leveraging AGPOM’s renewable energy credit (REC) program; reducing operating costs and lowering carbon footprints; obtaining discounted green consulting services; accessing green attorneys at discounted rates; and more.

We are all citizens of the world. If we can offer our clients services that help them adopt greener practices while ensuring the health of their bottom line, so much the better—for all of us.